Due to rising US bond yields and a stronger US currency, foreign portfolio investors’ (FPIs) performance on D-Street has been modest thus far in August after consistent buying in the previous three months. As of August 26, FPIs bought Indian shares worth 10,690 crore and invested a total of 14,766 crore across debt, hybrid, debt-VRR, and equities, according to statistics from National Securities Depository Ltd (NSDL). The 10,690 crore amount also covers investments in the primary market and bulk transactions.

Due to rising US bond yields and a stronger US currency, foreign portfolio investors’ (FPIs) performance on D-Street has been modest thus far in August after consistent buying in the previous three months. As of August 26, FPIs bought Indian shares worth 10,690 crore and invested a total of 14,766 crore across debt, hybrid, debt-VRR, and equities, according to statistics from National Securities Depository Ltd (NSDL). The 10,690 crore amount also covers investments in the primary market and bulk transactions.

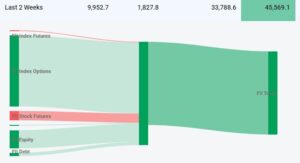

FPIs have sold Indian stocks worth $15,817 crore in the cash market so far this month. According to economists, the strength of the US dollar index, which is currently at 104, and the US 10-year bond yield, which is still around 4.25 percent, are short-term headwinds for FPI flows to emerging countries like India.

According to the combined NSDL figures, the August FPI investment up to August 26 was 10,689 crore. However, this statistic takes into account investment made through the primary market and bulk transactions, which have recently gained pace. Consistent purchases of capital goods are a key aspect of FPI investments. According to Dr. V K Vijayakumar, the Chief Investment Strategist at Geojit Financial Services, they have recently begun selling financials.

Analysts noted that the most recent FED minutes were more hawkish than anticipated. The 2-year yield is currently trading at 5 per cent, while the US 10-year yield is trading at a 16-year high. However, market observers claim that the valuation of Indian equities is not poor and is backed by money flow.